|

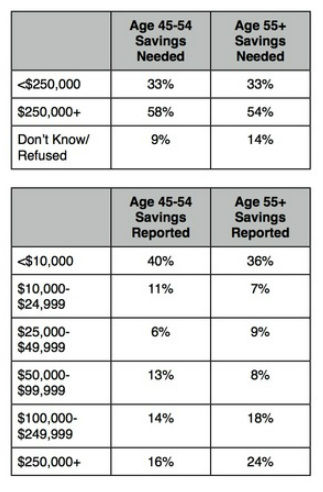

3/28/2013 0 Comments Savings Expectations vs. Reality Stormy skies for retirement savings? For the last few years, retirement confidence has been at or near historically low levels. Even as reports of a rebounding economy surface, confidence continues to remain low. Perhaps one explanation for this is apparent in the data reported in the annual Retirement Confidence Survey (RCS) conducted by the Employee Benefit Research Institute (EBRI) and Mathew Greenwald & Associates. When you look at the retirement savings expectations of workers and then compare this to actual savings, there is a very significant gap. For example, let's consider the age groups closest to retirement. For those ages 45 to 54, as well as those age 55 and above, more than half think that they will need $250,000 or more in savings and investments for a secure retirement (excluding housing and defined benefit plans). While those 55 and above may still have some working years to accumulate additional retirement savings, and those in the 45-54 bracket even more years, the red flag is that more than half of both demographic groups have less than $50,000 in savings reported. The end result is that people now expect to work longer. A decade ago in 2003, 24% of those in the 45-54 bracket expected to retire at age 66 or later; in 2013, that figure is up to 35%. Similarly, in 2003, 29% of those 55 or older thought that they would retire at age 66 or later; that has risen to 44%. What is worrisome is that even if more individuals plan to work longer to overcome the savings shortfalls, in reality, more than half have retired sooner than expected due to adverse circumstances such as health problems or disability. (Numbers in tables below are from the RCS and may be >100% due to rounding.)

0 Comments

Leave a Reply. |

Blog Author - Ken FelsherWith over 25 years of writing, editing, and research experience. I enjoy sharing with my readers my love of working with content on a variety of subjects. CategoriesAll 401(k) 402(g) Boomers Catch-up DB Dc Deferral Limit Defined Benefit Defined Contribution ERISA Healthcare Participation Pension Professionally Managed RCS Retirement Retirement Confidence Tax Code Vanguard Women Working Archives

March 2015

|